Getting ready to consolidate debt can sometimes result in disappointment. But a loan with realistic terms can really be a big help to you to get your financial freedom back. The information shared here can help you when you are considering debt consolidation.

When choosing your debt consolidation company, look at the big picture. Obviously, it is important to get your immediate financial situation in order, but you must also look to the future and understand how this company will continue to work alongside you. Many companies offer services that will show you how to avoid financial problems after you’re debt free.

Look for a debt consolidation loan with low fixed rates. Using anything else may make you guess your monthly payments, which is hard to work with. Your loan should end up improving your financial situation with positive loan terms and a fixed rate.

Credit Card

Look into any credit card offers you get in the mail; it might be an excellent way of consolidating any debts you have. It can save you money on interest payments, and it’ll consolidate all those bills into just one thing to deal with! When you’ve consolidated your debt on a single credit card, try paying that off prior to the introductory interest offer expiring.

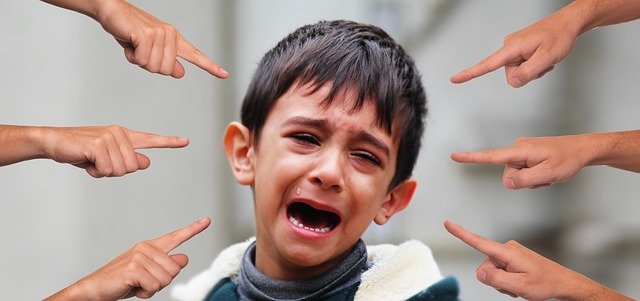

If you have to turn to debt consolidation measures, you should seriously consider why you allowed yourself to accumulate so much debt. You definitely don’t want to find yourself in a similar position down the road. You must learn how this occurred to you now so that you can implement measures to prevent it in the future.

Any debt consolidation organization should personalize a program to the individual. If you’re not able to get people at the company to take their time with you, then you probably aren’t going to get good service and should look for help elsewhere. That approach is unlikely to be effective.

Rather than getting a loan through debt consolidation, think about paying the credit cards off through what’s called a “snowball” tactic. Pick the card that has the highest interest and try paying it off as soon as possible. Then take the money saved from not having that payment and place it towards paying off your next card. This cycle really works.

Debt Consolidation

Find out what fees are charged by any debt consolidation business you are considering. Be sure that any written contracts you sign give a thorough detailing of applicable fees. You also need to know how your debt payment is going to be divided with your creditors. The debt consolidation contract should be able to give you a printout of how much and when they will pay your creditors each month.

Can debt management get you out of your financial hole? When you take control of your situation, you’ll have the ability to pay off your debt much more quickly due a possible lower settlement and less interest over the long run, which means you can get on your feet faster. Just find a good firm to negotiate lower interest rates on your behalf.

You should create a budget. Whether or not you’re going to get help from a debt consolidation business with this, you should still know where all of your money is going. If you’re able to make smarter financial decisions you’re going to do better in the long run.

Refinancing your mortgage may enable you to bypass the loan consolidation option. The money that left over from your mortgage payment reduction can be used to pay off debts that are outstanding. You can shave off quite a bit of time off your efforts.

Getting yourself dug out of a financial hole is something you cannot do if you do not have the right kind of information. Use the above information to help you with your debt consolidation. If you do it the right way, you will be on your way to financial freedom once again.