There are many reasons why you may have a poor credit history. Credit cards could have been your primary means of support while you were gaining an education, a passion for shopping may have gotten the best of you or the decline in the economy might have left you jobless for a time. The good news is that there are some things that you can do to repair it.

Having a good record allow you to qualify for things like a home mortgage. Timely mortgage payments augment your credit score. Owning a valuable asset like a house will improve your financial stability and make you appear more creditworthy. This will be beneficial when you apply for loans.

When looking to improve your credit, avoid companies claiming that they can remove negative information if the debt is true. Bad marks on your report will not go away for seven years. Items that you can get taken off your record are those that have been reported incorrectly or unfairly.

If you are looking into a credit counselor, be sure to find out information about them before you choose to use them. Some counselors truly want to help you, while others are untrustworthy and have other motives. Some will try to cheat you. A wise consumer will find out if the credit counselors they deal with are legitimate or not.

Do not do anything that will make you end up in jail. There are plenty of credit scams that purport to erase your existing credit file and create a new one. Do not think that you can get away with illegal actions. The legal proceedings will be costly, and you may even be sent to jail.

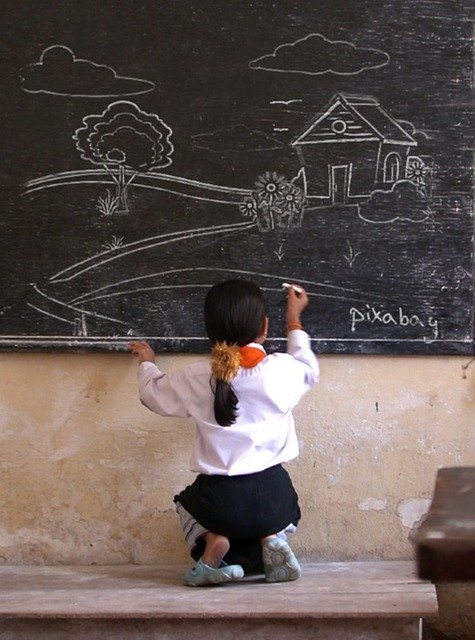

Credit Card

Requesting that your credit card limits be lowered can benefit you. It will keep you from overextending yourself financially, it sends a great signal to the credit card companies that you are a responsible borrower, and you will have an easier time getting credit in the future.

Before you agree to any sort of repayment plan to settle your debts, consider how this will affect your credit score. You should know all about the methods you can use if you are going to enter into an agreement with someone. Creditors just want their money and really aren’t interested on how it will affect your score.

If you are living beyond your financial ability, stop now. This takes time and a change in attitude to accomplish. In the last decade, it has been way to easy for people to get credit. Many people have used this credit to buy items that they really could not afford at the time, and are now paying the price. Look at your budget, and decide what is realistic for you to spend from month to month.

Take the time to carefully go over all your credit card statements. Check to be sure that you actually purchased the things that are listed on your statement, so that you are only paying for things you bought. It is only your responsibility to make sure everything is correct and error free.

For a better credit rating, lower the balances on your revolving accounts. You can raise your score by lowering your balances. When your available credit passes 20, 40, 60, 80 or 100 percent, it gets noticed by the FICO system.

Credit Score Repair

An experienced, honest credit score repair agency can be very helpful. Just like any other field, credit score improvement has plenty of companies that do not provide what they promise. It is sad to see how many people have been taken advantage of by credit repair scams. If you do some online research, you can find out what people really think about the various credit score repair agencies. This will help tremendously in choosing a safe and effective company.

Be very careful about credit professionals who state that they could fix your credit quickly. A lot of people are having difficulty with their credit, and there are lawyers that try to exploit these people with illegal and ineffective credit restoration services. Check the reviews and reputation of any lawyer or credit score repair firm thoroughly before you contact them and certainly before you give them any money.

Unfortunately, sometimes you have more debts than you have money to pay them off. To make sure everyone gets a share, spread out your money distribution. Regardless of whether you are making the minimum payments or a little more, getting some money will keep your creditors at bay and may stop them from calling collection agencies.

Devise a plan for paying off any collection accounts or past due debts. While these items will still appear on your report, you will no longer be penalized by having so much unpaid debt.

Be aware that threats made by a bill collector are illegal. There are consumer laws which limit the things that a collection agency can do to you.

Restoring your credit rating looks at first like an uphill battle, but with sound effort and the right advice, that battle can be won. Use what you have read here to get back on track with your credit.